Investing in digital currency on the Stellar Network offers a path to long term investment in an international coin offering (ICO) with the opportunity for generation wealth. For about one dollar, less than the cost of a cup of coffee these days, you can start a portfolio on the blockchain with the potential to realize huge gains over the next five to ten years.

Where there is money, there are also scammers. Ninety percent of the tokens found on the Lobstr platform are illegitimate tokens minted by scammers hoping you will purchase them accidentally. Without a foundation in digital asset education, it is easy to lose money to scammers, simply by mistaking a misspelled token name for a real one.

Although the long-term goal for the Stellar Network is safety, security and transparency, the digital space is still rife with counterfeiters while we await the anchor version of the platform. Many criminals occupy the Telegram space, awaiting the launch of legitimate tokens so they can quickly create copycats that closely resemble the originals.

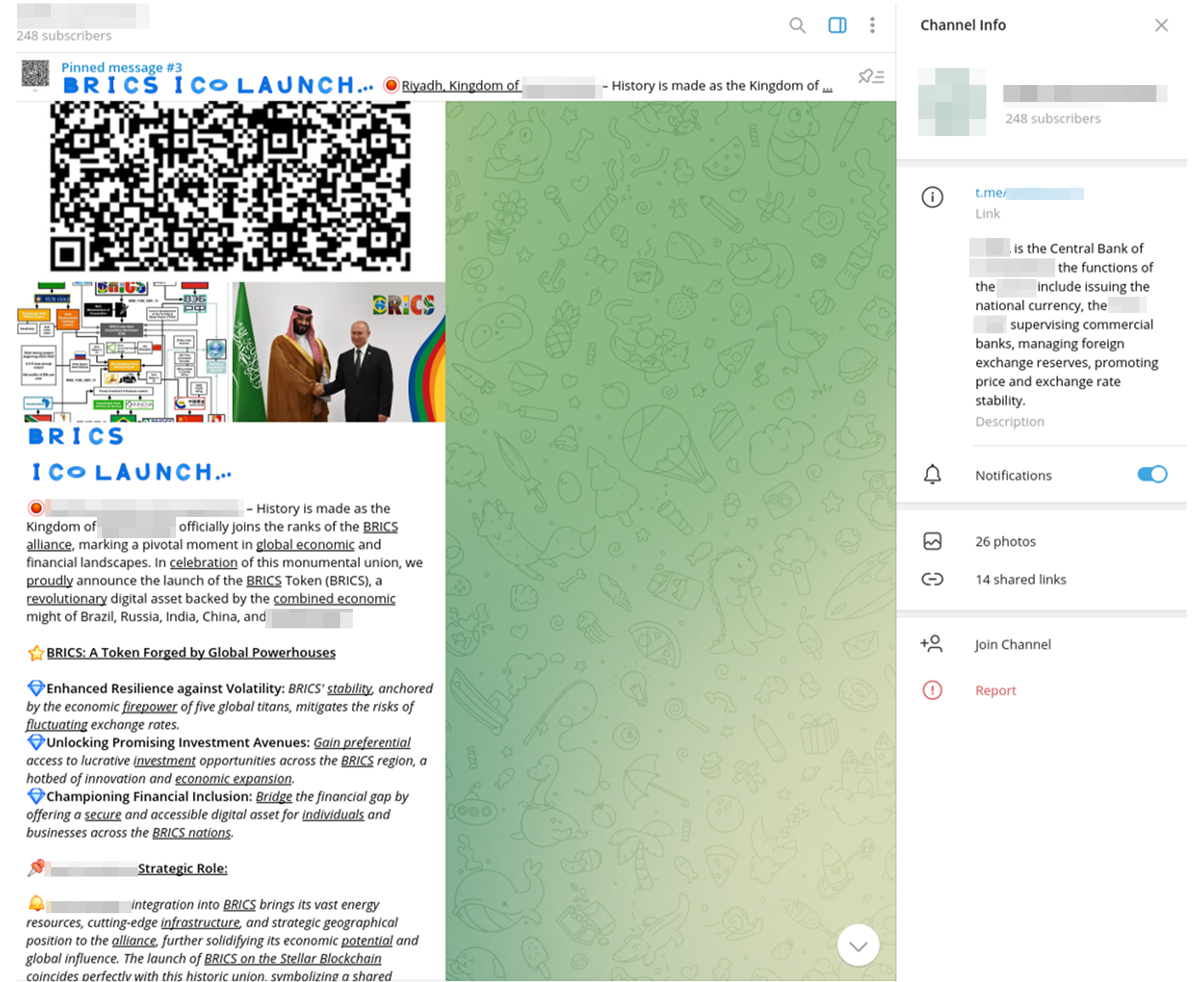

One of the major offenders is a Telegram user named Whiplash 347, whose fake BRICS token was called out by Resecurity in a recent article outlining how these perpetrators operate. Whiplash 347 has a large following; he can rapidly raise half a million dollars by incentivizing goals with large rewards.

Resecurity highlights a common tactic; scammers often mint cryptocurrencies with the names of real ones to attract investors looking for legitimate investments. The situation is further complicated by the Lobstr platform which often displays fake tokens when you perform a search for a legitimate one.

The article highlighted this perpetrator’s most common schemes – acting as an official on behalf of a major oil corporation, a national financial regulator, counterfeiting national fiat currency and pretending to represent major real estate development. The Monetary Authority of Singapore and Central Bank of one of the countries in the Middle East were erroneously referenced as parties involved in these schemes to lend credibility to the ICOs.

Solidus Labs claimed there have been over two million investors defrauded by these schemes surpassing the number of victims effected by traditional crypto disasters.

One common method for defrauding investors involves “rug pulls” which entails the retraction of the tokens from the investor once that investor attempts to sell them.

Stay Vigilant

Following an anonymous person’s online advice without doing your own homework tends to be one the biggest pitfalls. Investors can protect themselves by researching the developers of tokens prior to investing.

For those who choose to off-ramp from Stellar now, they will lose the money they invested in counterfeit tokens. Those who purchased these tokens by mistake will be able to swap them out in the future using the coming Cheesecake token designed to allow investors to exchange scam assets for legitimate ones.

Related posts:

- America’s Crypto Regulation Model Should Emulate The Caribbean

- What Is Staking And What Does It Mean In Relation To Crypto?

- Top Crypto Presale: Investor Enthusiasm Peaks as BlockDAG Batch 4 Presale Nears End Amid Quant and Dogecoin Price Surges

- BlockDAG Presale To Hit $8 Million Unlocking Opportunities Amidst XRP’s Correction and Exploring Arbitrum Tokens